Planned Giving

NC State University’s Planned Giving program allows alumni and friends of NC State to make a larger investment in the future of the university through the establishment of various planned giving instruments such as but not limited to charitable remainder trusts, charitable lead trusts, pooled income funds, or other trusts; assets subject to a charitable gift annuity or donor advised fund; and/or assets held pursuant to any other agreement where NC State’s Associated Entity is owner, trustee, remainderman, or income beneficiary.

The Office of Gift Planning works with each donor to meet their goals by establishing one of the aforementioned types of planned giving instruments.

As of 2016, the gift administration & Investment Management services were outsourced to Kaspick & Company, LLC. The Office of Investments provides investment management oversight.

The investment approach takes the principles of modern endowment theory and practice and adapts them to the needs of planned gifts. Each account has a disciplined strategy, using low cost funds diversified across stocks and bonds designed to meet the donors specific risk and return objectives.

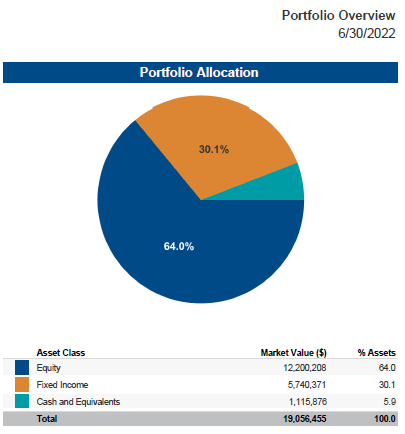

As of June 30, 2022, nine University Associated Entities invested in the Planned Giving program reflecting a market value of $18.98 million. The $18.98 million represents 42 unitrusts and 146 gift annuities invested across equity and fixed income strategies.