SRI Fund

History

On Sept. 27, 2013, Chancellor Woodson announced the Park Foundation’s (Donor) $50 million gift to the Park Scholarships — at the time it was the largest single gift in the university’s history. Intended to plant the seed of an endowment, this gift, with other support, aimed to sustain the program in perpetuity.

For investment purposes, the assets of endowments contributed by any donor who requests that it be invested in a sustainable, responsible and impactful manner will be held by the North Carolina State University Foundation, Inc. in a separate endowment fund called the Sustainable Responsible Impact Fund (the “SRI Fund”).

Sustainable investing is an all-inclusive term that encompasses activities and strategies under the responsible investing and/or sustainable investing umbrella. Such strategies include negative/exclusionary screening, positive/best-in- class screening, norms-based screening, integration of ESG factors, sustainable themed investing, impact/community investing and corporate engagement and shareholder action.

Investment Approach

The SRI Fund’s investment strategy is aligned with its commitment to successful sustainability through balanced, ethical solutions that are economically viable, environmentally sound and socially just so that current and future generations may thrive. The SRI Fund intends the integration of environmental, social, and corporate governance (ESG) considerations into investment management strategies, processes, and practices in the belief that these factors can benefit the fund’s performance and provide a qualitative impact consistent with the values, culture and mission of NC State University.

The SRI Fund will seek to achieve a competitive total return through a portfolio of stocks and bonds, privately held companies, real assets, and other instruments that offer income and capital growth opportunities.

Governance

The NC State Foundation Board of Directors’ (Board) is responsible for overseeing all aspects of the investment program, including development and approval of the Investment Policy Statement in a prudent manner with regard to preserving principal while providing reasonable returns.

The Board delegated authority by Board Resolution to the Foundation’s Treasurer and Director of Investments, jointly for SRI Fund management and oversight, including investment decisions, with updates to be provided to the Board at regularly scheduled meetings.

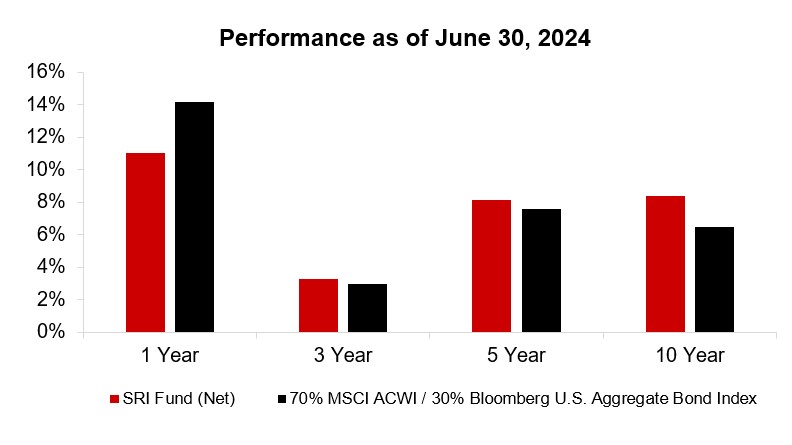

Performance

As of June 30, 2024, the SRI Fund had a market value of $68.4 million, representing a one-year net return of 11.0%. After spending distributions, the Fund saw a year-over-year increase of $3.7 million.