Intermediate Term Fund (ITF)

History

The NC State Intermediate Term Fund ( the NC State ITF) was established in 2014 and, as a pooled fund for the collective investment of operating funds, the NC State ITF consists of participants’ excess cash balances, which are defined as funds not needed for normal operating purposes. Generally, the ITF will not include operating funds needed within the next year, endowed funds or those funds that are specifically excluded by law or contractual agreement.

Investment Approach

The NC State ITF is designed using a total return concept while providing a margin of safety in the unlikely event that the short-term operating cash pool is insufficient to meet any current or unplanned expenditure. The investment of funds shall consider asset diversification, total return, suitability, and the experiences, quality and capability of external managers.

The primary investment objectives are preservation of capital, liquidity and yield. The yield objective is to generate at minimum an annual 2% distribution rate in normal market environments while also focusing on capital preservation. Given the total return concept and pricing volatility, a reserve of 3% of the invested funds has been established to protect the Net Asset Value (NAV) during times of extreme down market events.

Governance

The Members Board will provide governance and oversight to the NC State ITF. The Members Board’s role includes approving other governance documents including bylaws, operating agreements, participant agreements, asset-based fees, and other policies, as it relates to the NC State ITF.

The Investment Committee is elected by the Members Board and is responsible for overseeing all aspects of the investment program. In carrying out these duties, the Members Board has formed the NC State ITF Investment Committee to assist in managing the assets of the NC State ITF.

The NC State ITF Investment Committee’s role is to report to the Members Board on matters pertaining to the investment of the NC State ITF assets, performance and compliance with the Investment policy statement.

Performance

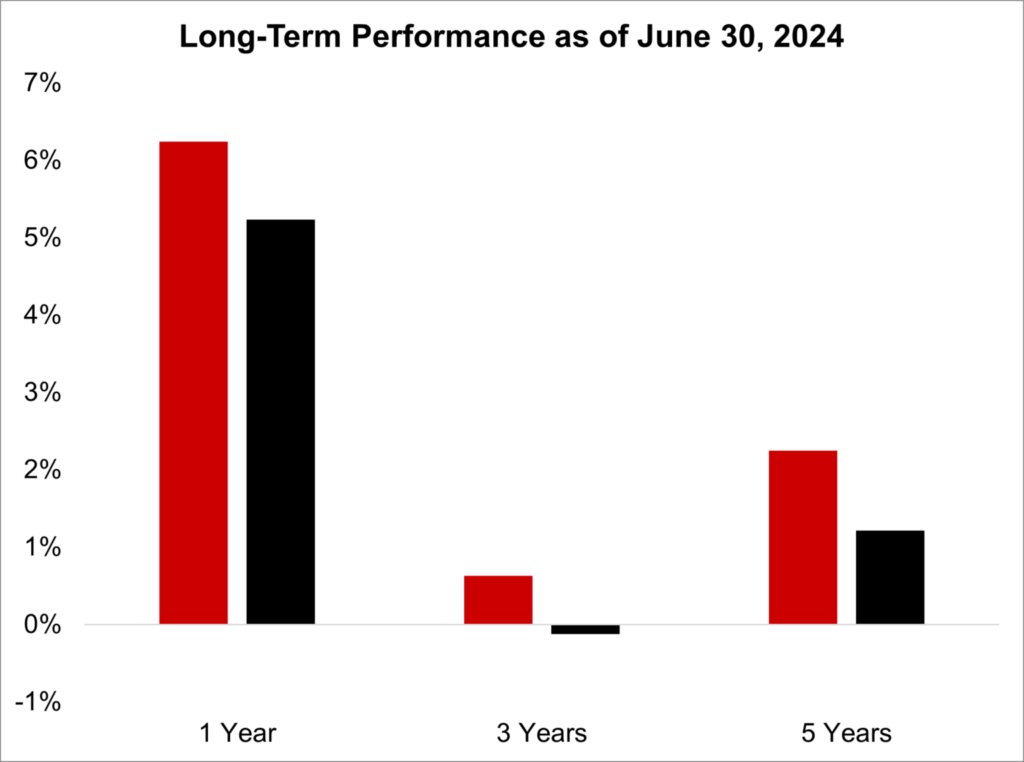

As of June 30, 2024, nine participants invested in the NC State Intermediate Term Fund reflecting a market value of $342.5 million, a year-over-year increase of approximately $19.7 million. The NC State ITF ended fiscal year 2024 with a return of 6.2%, outperforming the Bloomberg Universal 1-5 year return of 5.2%.

As of June 30, 2024, the NC State ITF outperformed its benchmark over 1-, 3-, and 5-year investment horizons. For the 5-year period ending June 30, 2024, ITF’s annualized return of 2.2% outperformed the Bloomberg Universal 1-5 year index by 1%.